If you haven’t used your VA loan yet — or you already own a home financed with a VA loan — you need to understand this before your next move.

The VA loan is not a one-time decision. It’s a long-term tool.

And how you use it early in your military career can directly affect how much flexibility and freedom you have at future duty stations.

One of the biggest mistakes military families make isn’t buying the wrong house. It’s assuming the VA loan is a single-use benefit instead of a strategy that can support multiple moves over time.

So can you use a VA loan more than once? Yes. But how and when you do it matters.

For a complete breakdown of how VA home loans work in Phoenix and near Luke Air Force Base, including eligibility, entitlement, occupancy rules, and PCS strategy, visit our full VA Loan Education Hub.

Quick Answer: Can You Use a VA Loan More Than Once?

Yes, you can use a VA loan more than once. In fact, many military members use a VA loan more than once throughout their career.

You may be able to:

- Sell and restore your VA entitlement

- Keep your current home and use remaining entitlement

- Reuse your VA loan after paying off a prior VA loan

- Structure multiple purchases across several PCS moves

The key is understanding how entitlement works and planning each move intentionally.

Why the VA Loan Is Not a One-Time Benefit

Your VA Loan Entitlement may give you more options than you realize, get familiar with your benefit. Many first-time buyers assume:

- “We’ll probably just sell when we PCS.”

- “It’s not worth buying if we’re only here a few years.”

- “We’ll figure it out later.”

What’s really happening is short-term thinking.

When you use a VA loan more than once strategically, you are not just buying a place to live for this assignment — you are creating options for the next one.

And in military life — where so much is out of your control — options matter.

The Two Primary Paths When You PCS

When you own a home financed with a VA loan and receive PCS orders, you typically have two main options.

Path One: Sell and Restore Entitlement

You sell the property, pay off the VA loan, and request restoration of your VA entitlement.

Benefits:

- Full entitlement restored (in most cases)

- Clean slate for next purchase

- No landlord responsibilities

- Simpler transition

This path often makes sense if:

- You prefer simplicity

- The market supports a strong sale

- Long-term holding does not align with your goals

Be aware of how some selling options can quietly limit you, like VA Loan Assumptions.

Path Two: Keep the Home and Use Remaining Entitlement

You convert the property into a rental and use your remaining entitlement to buy again at your next duty station.

Benefits:

- Long-term equity building

- Potential rental income

- Portfolio growth over time

- Strategic compounding across moves

Even VA entitlement limitations can often be structured strategically with the right planning.

Both paths are valid. The difference is whether you are thinking only about this assignment or about the next two or three.

Example 1: Stacking Two VA Purchases Over 10 Years

A service member buys at their first base using a VA loan at age 25.

- Purchase Price: $350,000

- Zero down

- Live there for four years

They receive PCS orders and decide to:

- Rent the property

- Use remaining entitlement to buy again at the next base

Now they have:

- One rental building equity

- One primary residence

- Two appreciating assets over time

By their mid-30s:

- The first property may have meaningful equity

- Rental income may have increased

- Their long-term options expand significantly

That outcome only exists because they treated the VA loan as a repeatable tool.

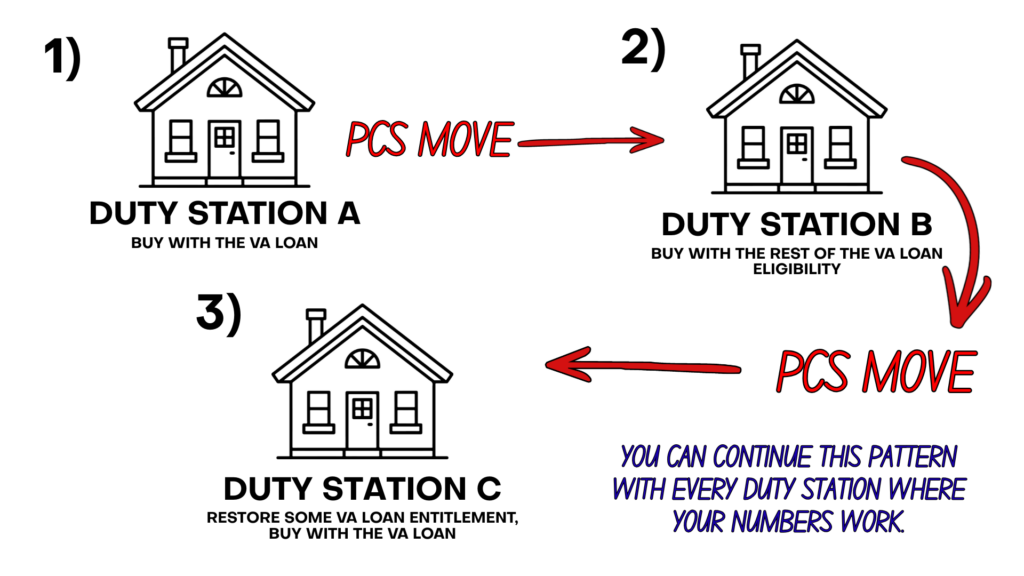

Example 2: Three PCS Moves Over a 15-Year Career

Consider a career service member.

Year 1–4: First Base

Buys with a VA loan and lives in the home.

Year 4–8: Second Base

Keeps the first property as a rental and uses remaining entitlement to buy again.

Year 8–12: Overseas Assignment

Rents both properties while stationed overseas.

Year 12–15: Stateside Return

Evaluates whether to sell one property and restore full entitlement or continue holding depending on long-term goals.

Over 15 years:

- Two or more properties may have been acquired using the VA benefit

- Appreciation may compound

- Rental income may offset mortgage payments

- Flexibility remains intact

This strategy does not depend on specific purchase prices. It depends on planning.

But What About VA Entitlement Limits?

You do not need to memorize entitlement math to use a VA loan more than once.

You do need to understand that entitlement determines structure, not eligibility.

In some cases, you may:

- Need a down payment if entitlement is partially used

- Structure purchases differently

- Sell strategically to restore full entitlement

The key is verifying your entitlement position with a VA-experienced lender before assuming you cannot buy again.

When Renting May Not Make Sense

Keeping a home as a rental is not automatically the right move.

It may not make sense if:

- The property will not rent competitively

- The numbers do not support it

- You do not want landlord responsibility

- Your long-term plans do not support holding

Strategic thinking means evaluating each PCS move independently instead of defaulting to one path.

The Difference Between Being a Tenant and Being a Homeowner Over Time

When you are a tenant, your housing payment goes entirely toward rent. You do not build equity, you do not benefit from appreciation, and when you PCS again, you leave without ownership.

When you are a homeowner, your mortgage payment gradually builds equity. You may benefit from appreciation over time, and when you PCS, you can sell and potentially walk away with proceeds or keep the property and convert it into a rental.

This is not about saying renting is wrong. In some situations, renting is appropriate. But over multiple duty stations, ownership often creates more flexibility than remaining a tenant across every move.

The Question That Changes Everything

Before each PCS, ask yourself:

What does doing this now give me the option to do later?

If buying creates multiple positive answers — equity, rental income, restored entitlement later — you are building flexibility.

If remaining a tenant creates fewer long-term options, that should factor into your decision.

First-Time VA Buyers: Why This Matters Now

If you have not used your VA loan yet, long-term thinking matters most right now.

Your first purchase sets the foundation for:

- How easily you can use a VA loan more than once

- How much entitlement remains available

- How flexible your next move can be

The goal is not just to maximize this assignment. It is to maximize the next two or three.

Current VA Homeowners: Don’t Default to Selling

If you already own with a VA loan, do not assume selling is your only path.

Evaluate:

- Rental feasibility

- Remaining entitlement

- Market conditions

- Long-term career plans

Sometimes selling is right. Sometimes holding builds leverage. Strategy determines the difference.

The Bottom Line

Yes, you can use a VA loan more than once. Many military families use a VA loan more than once over the course of their careers.

The bigger question is whether you will use it intentionally.

The goal is not just to get through this PCS. It is to keep your options open for the next one.

If you are active-duty and planning your next move — whether this is your first VA purchase or your third — clarity beats assumptions.

Start with our PCS to Luke AFB Home-Buying Checklist, and if you want to understand how your VA entitlement supports multiple moves, schedule a strategy conversation so you are planning with data instead of guesswork.

+ show Comments

- Hide Comments

add a comment