If you’ve received PCS orders and already own a home — or you’re considering buying your first — one of the most common questions that comes up is:

“Can I use my VA loan again after a PCS?”

It’s a smart question. PCS moves, VA loan PCS rules, and long-term planning often collide, and a lot of military families get incomplete or overly simplistic answers.

The reality is this: yes, you can use your VA loan after a PCS, but how and when you use it matters. The VA loan is flexible, but it isn’t unlimited, and PCS timing adds an extra layer of strategy that’s easy to miss.

This guide explains what the VA actually allows, how PCS orders affect your options, and how military families use the VA loan strategically over multiple moves — not just one.

For a complete breakdown of how VA home loans work in Phoenix and near Luke Air Force Base, including eligibility, entitlement, occupancy rules, and PCS strategy, visit our full VA Loan Education Hub.

Quick Answer: Can You Use Your VA Loan After a PCS?

Yes, you can use your VA loan after a PCS.

Most military families can use their VA home loan benefit more than once, including after relocating to a new duty station. Your options depend on how much VA entitlement is currently in use, whether you sell or keep your previous home, and how your PCS timing is structured. With the right planning, some buyers can even use a VA loan before their PCS.

Yes, You Can Use Your VA Loan After a PCS — Here’s Why

A PCS does not cancel or reset your VA loan benefit.

Your VA loan benefit is tied to your entitlement, not your duty station. That means:

- You can use a VA loan more than once

- You can use it again after a PCS

- You may be able to use it before your PCS, if structured correctly

What changes is how much VA Loan entitlement you have available and how the VA’s occupancy rules apply to your situation.

That distinction is where most confusion — and bad advice — comes from.

VA Loan Entitlement: The Key Factor After a PCS

When you use a VA loan, you don’t “use it up.” Instead, a portion of your entitlement is tied to the home until one of two things happens:

- You sell the home, or

- You pay off the VA loan (often by refinancing)

According to the U.S. Department of Veterans Affairs, VA loan entitlement determines how much you can borrow and whether you may need a down payment when using your VA loan again, especially after a PCS.

If you PCS while still owning a home, your ability to use a VA loan again depends on factors like:

- How much VA Loan entitlement is currently tied to the first home

- The purchase price of the next home

- Whether the original home will be sold or kept

This is why two service members with similar income and rank can have very different outcomes when trying to buy again after a PCS.

This is why understanding entitlement usage matters so much — especially for military families planning multiple moves. You can learn more about long-term planning in our guide on using a VA loan benefit strategically over time.

Can You Keep Your Old Home and Still Use a VA Loan?

Sometimes — and this is where strategy matters.

If you PCS and want to keep your current home as a rental, you may still be able to use a VA loan again, depending on:

- How much entitlement is being used

- How much equity you have in the home

- Local loan limits and pricing

- Your lender’s experience with VA loans

There’s no universal yes-or-no answer. This decision should be evaluated before you list, rent, or buy — not after.

If you’re considering keeping a home as a rental, it’s also important to understand how VA property standards and appraisals come into play. This is covered in more detail in our breakdown of VA loan minimum property requirements.

VA Loan Occupancy Rules and PCS Orders

The VA requires that you intend to occupy the home as your primary residence.

These VA Loan occupancy rules and PCS go hand in hand! If you are hoping to buy a home during military PCS, these rules usually mean you have to:

- Plan to move into the home within a reasonable timeframe

- Have PCS orders support the relocation

- Accept that temporary housing or short delays may be required

You don’t have to live in the home forever. Many military families buy with a VA loan, PCS later, and then convert the property to a rental — as long as the original occupancy intent was legitimate.

This is one of the biggest misconceptions that keeps military families from buying when it could actually work in their favor.

Many PCS buyers worry that VA appraisals make this process harder than it is. In reality, most of the concern comes from myths, which we address in our article on VA appraisals and common deal-killer misconceptions.

Can You Buy Before a PCS Using a VA Loan Benefit?

Yes — and using your VA Loan entitlement multiple times (even having more than one loan at a time) is more common than many people realize.

Buying before a PCS can make sense if:

- You’re confident in the next duty station

- Your timing and financing are aligned

- The purchase is structured correctly

This approach can reduce stress, avoid rushed decisions, and give you better housing options near base — but it requires coordination between your lender, Realtor, and PCS timeline.

Done incorrectly, it can limit your entitlement or create unnecessary risk. Planning is the difference.

First-Time Buyers: Why Buying Now Doesn’t Eliminate Future Flexibility

If this is your first VA loan, here’s the reassurance many buyers need:

Buying now does not lock you out of future opportunities.

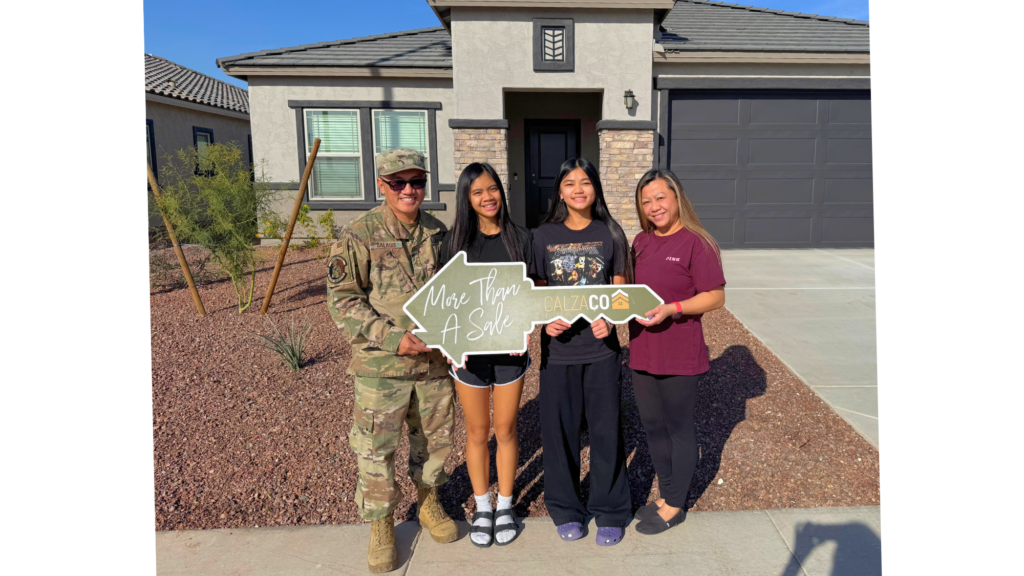

Many military families:

- Buy at one duty station

- PCS later

- Buy again using remaining or restored entitlement

The key isn’t avoiding buying — it’s understanding how today’s decision affects your options later.

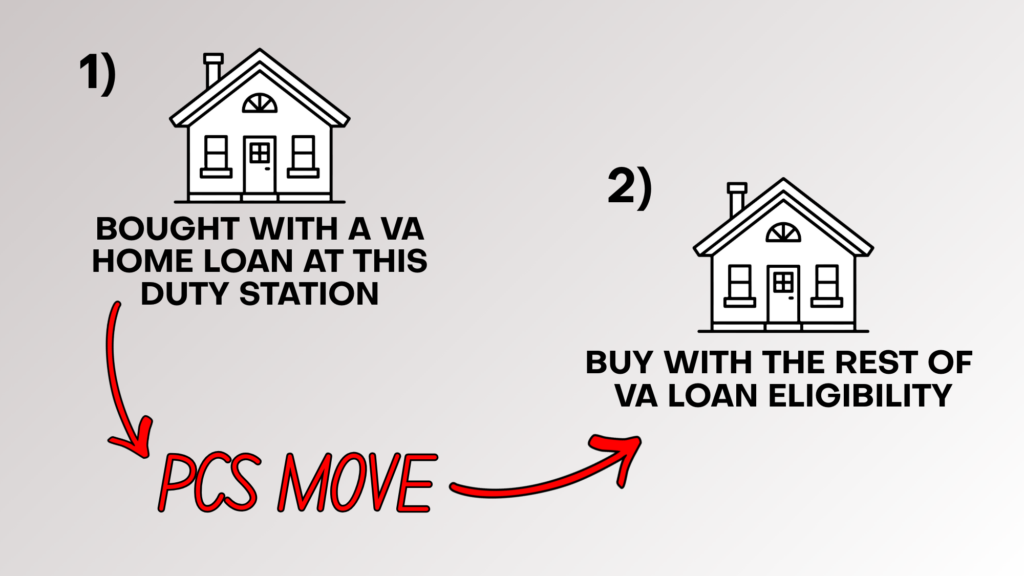

How Military Families Use the VA Loan Strategically Over Multiple PCS Moves

The VA loan works best when it’s treated as a long-term tool, not a one-time benefit.

Strategic buyers think about:

- Entitlement usage across moves

- Equity growth versus renting

- PCS timing and market conditions

- Choosing locations with long-term demand

This approach is especially important in high-growth areas like the West Valley near Luke Air Force Base, where housing decisions can have lasting impact.

This approach is especially important in high-growth areas like the West Valley near Luke Air Force Base, where choosing the right location can impact both flexibility and long-term demand.

The Bottom Line

You can absolutely use a VA loan after a PCS — and often more strategically than you might expect.

The mistake isn’t buying or waiting.

The mistake is making PCS housing decisions without understanding how VA loan rules actually work.

If you want clarity before your next move:

- Start with the PCS to Luke AFB Home-Buying Checklist to understand your timeline and options

- Or talk through your VA entitlement and PCS plan before making a decision that affects multiple duty stations

+ show Comments

- Hide Comments

add a comment