VA loan assumptions are often marketed as a powerful advantage in higher interest rate markets.

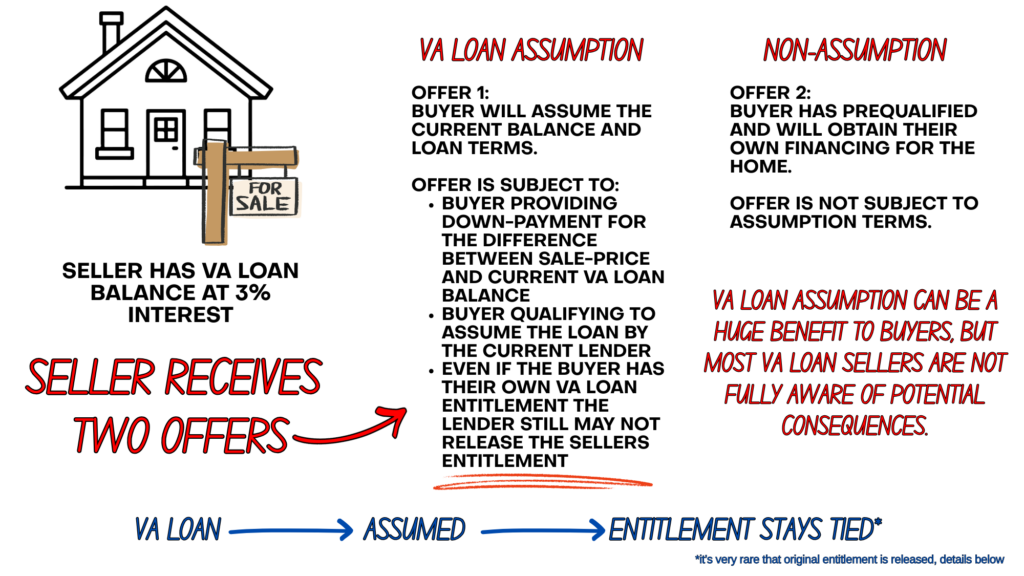

Sellers are told they’ll attract more buyers. Buyers are told they’ll lock in a below-market interest rate. What’s rarely explained clearly is how VA loan assumptions work, and how choosing to assume a VA loan affects VA entitlement — especially for sellers who may unintentionally limit their ability to use a VA loan again if the assumption isn’t structured correctly.

This guide explains how VA loan assumptions actually work, what happens to VA loan assumption entitlement for both buyers and sellers, and when an assumption may — or may not — make sense. If you want a better understanding of what VA entitlement is and what it does for you, review VA Loan Entitlement 2026.

For a complete breakdown of how VA home loans work in Phoenix and near Luke Air Force Base, including eligibility, entitlement, occupancy rules, and PCS strategy, visit our full VA Loan Education Hub.

Quick Answer: What Happens to VA Entitlement in VA Loan Assumptions?

VA entitlement is not automatically restored when a VA loan is assumed. If someone assumes your VA loan and does not substitute their own VA entitlement, your entitlement may remain tied to the property. This can limit or prevent your ability to use a VA loan again. While VA loan assumptions can work in rare scenarios, most sellers and buyers underestimate the long-term impact on entitlement.

What Is a VA Loan Assumption and How do VA Loan Assumptions Work?

A VA loan assumption allows a qualified buyer to take over an existing VA loan — including the interest rate, remaining balance, and remaining term — instead of obtaining a new mortgage.

Because the loan stays in place, assumptions can look appealing when current interest rates are higher than the assumed loan’s rate.

However, assumptions are not automatic, and they come with rules, approvals, and long-term consequences that are often glossed over.

When buyers consider whether to assume a VA loan, it’s important to understand that the loan, the interest rate, and the entitlement structure all stay in place unless specific steps are taken.

Why VA Loan Assumptions Are Often Oversold

In higher-rate markets, VA assumptions are frequently marketed as a “no-brainer” for sellers to offer in higher interest rate market environments. In practice, assumptions narrow the buyer pool, slow down transactions, and can quietly damage the seller’s future VA loan flexibility.

The interest rate benefit tends to get all the attention, while entitlement impact gets ignored — until the seller tries to buy again.

The Critical Issue: VA Entitlement Does Not Automatically Reset

When a VA loan is sold and paid off, entitlement can typically be restored. When a VA loan is assumed, the loan is not paid off.

That means the VA entitlement tied to that loan does not automatically return to the seller, and unless specific steps are taken, entitlement remains attached to the property.

This distinction is the single most important thing sellers need to understand before agreeing to an assumption.

Substitution of Entitlement: Why It Matters (and Why It’s Rare)

In some cases, a VA-eligible buyer can substitute their own entitlement when assuming a VA loan. For this to happen, the buyer must have sufficient available entitlement, may need cash to cover any gap, the lender must approve the substitution, and the paperwork must be structured correctly.

When substitution occurs, the seller’s entitlement may be restored. However, this outcome is uncommon and requires precise alignment between buyer qualification, entitlement availability, and lender approval. It should never be assumed as the default outcome.

How VA Loan Assumptions Affect Sellers

Sellers are often surprised to learn that their VA entitlement can remain tied up indefinitely, they may not be able to use a VA loan again without a down payment, and the issue may not surface until years later.

This is especially impactful for active-duty service members, veterans planning to buy again, and military families facing PCS or overseas assignments. Accepting an assumption for short-term convenience can create long-term restrictions.

How VA Loan Assumptions Affect Buyers

Buyers considering a VA assumption should understand that assumptions still require underwriting and approval, their own VA entitlement may be used, they may need significant cash to bridge price differences, and closing timelines are often longer than traditional purchases.

Another this to consider is the effect VA occupancy rules have on your purchase. An assumed VA loan is not a shortcut — it is still a mortgage with real financial and strategic consequences.

When VA Loan Assumptions Can Make Sense

VA loan assumptions are not inherently bad, but they are rarely ideal. Situations where they may make sense include a seller facing a distressed or time-sensitive situation, a VA-eligible buyer with sufficient entitlement and cash, and a lender willing to approve substitution of entitlement.

Even in these cases, assumptions should be treated as exceptions, not standard strategies.

Why Assumptions Matter for PCS and Overseas Moves

For military families who PCS frequently or receive overseas orders, entitlement decisions compound over time.

An assumption that ties up entitlement can limit zero-down purchasing power on return, reduce speed and flexibility during PCS windows, and restrict long-term VA loan strategy.

This is why VA loan assumptions should always be evaluated alongside PCS planning, not in isolation… you want the flexibility to use your VA Loan after PCS.

The Strategic Takeaway

VA loan assumptions are often framed as a rate play. In reality, they are an entitlement decision. For most sellers, a traditional sale that allows entitlement restoration is the safest path.

For buyers, understanding the full impact of an assumption prevents future limitations. Before agreeing to a VA loan assumption — on either side of the transaction — it’s worth understanding what you’re trading today for flexibility tomorrow.

Not Sure How a VA Loan Assumption Affects You?

If you’re considering a VA loan assumption — or being asked to allow one — a strategy conversation before you agree can help you protect your VA entitlement and avoid long-term surprises.

Schedule a VA loan assumption strategy consult to review your options before making a decision.

PCSing, retiring, or ending your active service in the Luke AFB or create Phoenix Metropolitan Area? Grab our PCS Guide and get set up for success by scheduling a strategy consult with us.

+ show Comments

- Hide Comments

add a comment